Traders Forex trading can spot several patterns on a Forex exchange rate chart that can help them figure out market momentum and market psychology for that specific currency pair.

Pattern recognition isn’t enough to actually deal, but when supplemented with technical indicators and other trading tools. Patterns can provide helpful information that can help traders gain a better understanding and make calculated decisions.

Reversal Patterns

- Double tops and bottoms

- Quad tops and triple bottoms

- Saucer bottom products

- Reversal Structures

Continuation Patterns

- Wedges

- Rectangular shapes

- Flags & Pennants

When it comes to identifying reversal patterns, there are three key guidelines to follow;

- There can be no reversal without a trend Forex trading.

- A reversal is signalled when a trend line is violated.

- Short-term reversal is less important than long-term reversal.

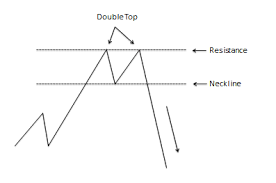

Double Tops & Double Bottoms

When it comes to identifying reversal patterns, there are three key guidelines to follow;

A combination of higher-high peaks and shorter high peaks constitutes a double top pattern in an uptrends. If the price does not break just above the high and the second peak remains at the same level, the trend may be about to reverse. Double bottom patterns may indicate trading opportunities above the nape of the neck Forex Traders .

Triple Tops & Triple Bottoms

When the routine candle falls below the third peak neckline, traders can open a purchasing position. Entry points can be set a few points just under the low of the first candle to close below the line. The third bottom is regarded as a strong support level, and a triple bottom reversion may be possible. Read more here Oanda minimum deposit

The Bottom of the Saucer

The Saucer Bottom is a protracted evolving pattern that frequently lacks a defined entry point and provides no direct positioning cues. This pattern shows a gradual loss of decline momentum followed by consolidation in a sideways market with the possibility of an upward trend return. Although saucers take a long time to grow, they are only visible on weekly, monthly, and annual charts. As a result, technical analysis is required to discover entry points.

Patterns of Continuation

Throughout trends, continuation structures are present when prices consolidate before continuing in the previous trend’s direction. When detecting continuation structures, the same three rules apply as when identifying reversal patterns.

The flag pattern usually consists of two lines slanting in the opposite direction of the trend. Market fluctuations in pennant patterns are slower than in triangle patterns. The move is usually by a flag.

Wedge

Wedge formations are ascending and descending triangle patterns with both angled sides sloping against the market trend. Wedges are used to indicate price consolidation and are rarely used to predict which way the price breakthrough. When support and resistance levels derived from a wedge are breached, it indicates that the trend will continue in the same direction.